The basic definition of “home equity” is the difference between what your home is currently worth and how much you owe on your mortgage and/or other loans secured by your home. Equity is calculated via a simple formula: determine the current Fair Market Value of your home and subtract how much you owe on your mortgage and any other loans secured by your home.

For example:

| Title | Amount |

|---|---|

| Your Home's Fair Market Value: | $350,000 |

| What you owe on Mortgage/other secure loans | $200,000 |

| The total equity in your home | $150,000 |

You can tap into your home’s equity to help pay for large expense items such as home renovation projects, wedding expenses, -interest debt consolidation, college expenses, sustainability upgrades like heat pumps or solar panels, or even that dream trip around the world you’ve always wanted to take.

There are two ways to do this. One is by securing a Home Equity Loan, where you’ll receive a lump sum payment of your loan amount at closing–you’ll then make fixed payments over the chosen repayment term.

You could also establish a Home Equity Line of Credit (HELOC), which allows you draw off of the equity in your home. This can be used either for planned expenses or as a “safety net” to help cover any large unforeseen future expenses. In this scenario, you only pay interest on the portion of funds you’ve used. HELOCs have a pre-established “draw” time period during which withdrawals can be made–usually a number of years.

How can I increase my home equity?

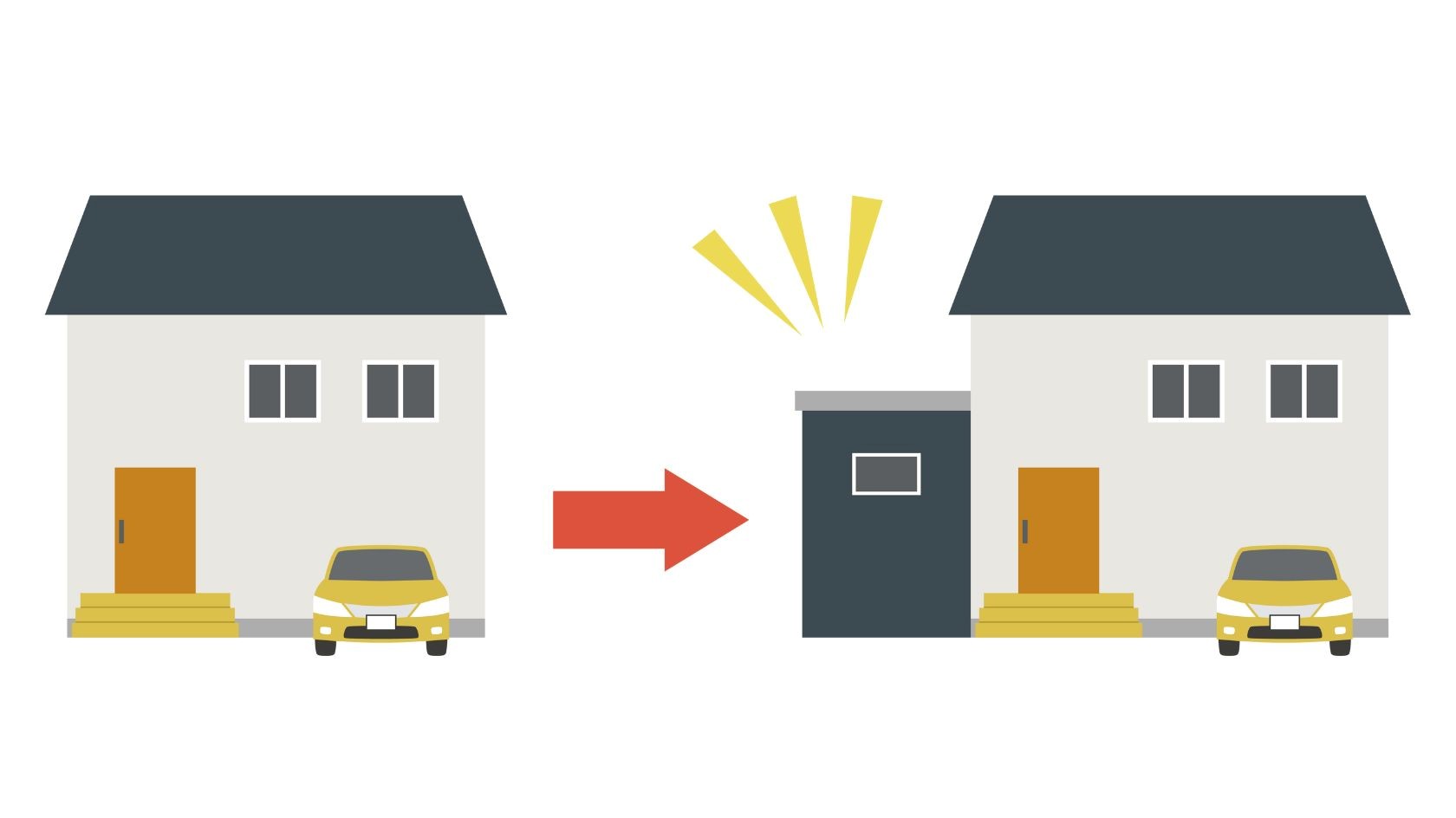

There are a few things a homeowner can proactively do to increase the equity in their home. Increasing the amount of the down payment when purchasing a home will automatically increase the owner’s equity by putting more equity directly into the home. Once you have a mortgage, making additional payments towards the loan principal above the regular monthly payment will accelerate the growth of equity. Refinancing a mortgage to a shorter term will allow more of your regular monthly payment to go toward paying down loan principal each month. Finally, investing in home upgrades through projects such as a kitchen remodel or adding a bathroom -can sometimes increase the value of your home, adding equity to your home over time.

Is a Home Equity Loan or HELOC right for me?

Which product is best mostly depends on what you plan to use it for. A Home Equity Loan may be used for consolidating other debts or making a one-time large purchase. A HELOC might be best for larger projects such as home renovations, college expenses, or having as a “safety net” for future, unanticipated expenses. You’re only making interest payments on the amount you use with a HELOC, rather than the full loan amount, and you have the flexibility to draw against the loan as needed for years.

Learn more

Have questions? We’re here to help. Set up a time to call or meet with our retail lending team.