As you’ll see in the lessons learned, being smart about credit, debt, and borrowing is a key part of overall financial health.

Matthew and Kendall’s Story

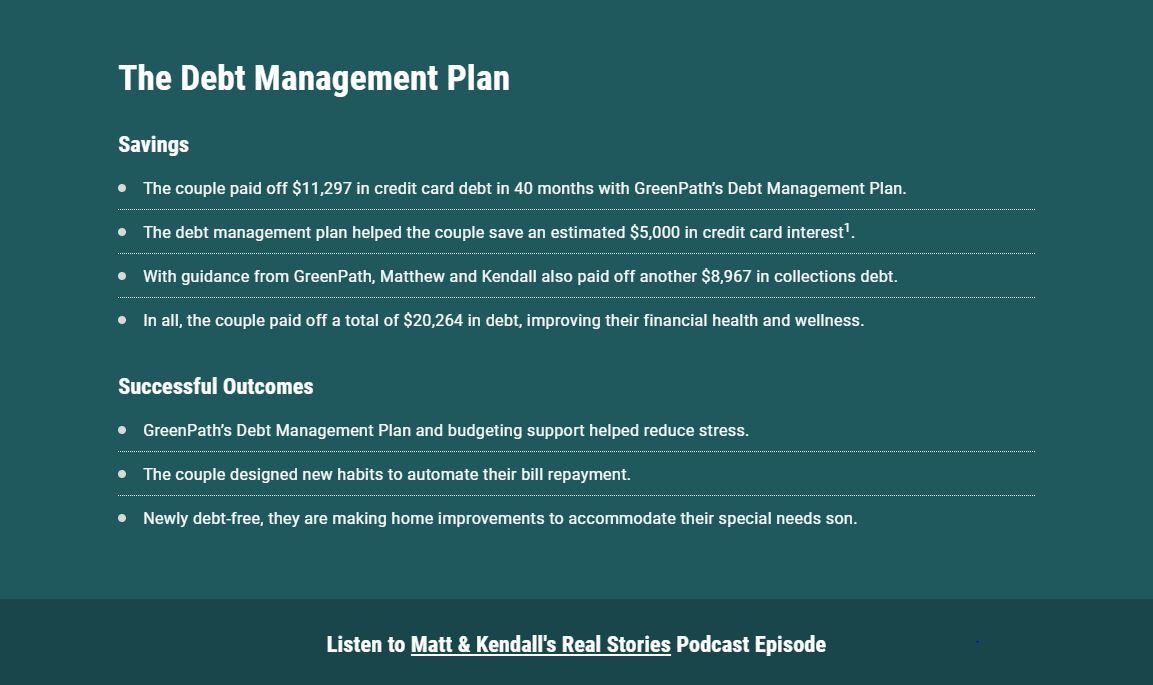

Matthew, Kendall, and their young family were under financial stress in years past. The monthly bills were piling up, and the couple found it difficult to manage everyday expenses on top of payments on more than $11,000 in high interest credit card debt. Additional debt of nearly $9,000 was in collections, impacting their financial health and credit scores.

The couple realized that with a poor credit history, the cost to take on additional loans would come with higher interest due to their low credit scores.

A GreenPath debt management plan and budgeting support helped the couple get smart about their credit and reduce stress. A caring counselor tailored the plan to their specific financial situation. The GreenPath counselor worked with the couple to design new financial habits to set aside money each month, and to help automate bill repayment.

Teaming with GreenPath, the couple paid off more than $11,000 in credit card debt and saved about $5,000 in interest charges – money they would have paid had they continued to pay the debt on their own. Along with the additional collection accounts, they paid off more than $20,000 in debt overall. The counselor also helped the couple customize an easy-to-follow spending plan to build up healthy financial habits going forward. Newly debt-free, they were able to make home improvements to accommodate their special needs son.

If you’re struggling, remember that debt is not just going to go away on its own. It’s best to look at it head on and take action.

Lesson #1: Good financial habits pay off!

The couple learned that good financial habits make a big difference. GreenPath’s debt management plan helped them be more intentional about their credit card usage. In addition, by budgeting wisely, they now set aside money for savings to help them achieve their long-term goals.

Lesson #2: There’s a smart way to manage credit

Matthew and Kendall realized that paying only the minimum each month toward credit card debt extended how long it would take to wipe out debt and added to the amount of interest they paid. By using a debt management plan, they reduced the time to pay off their debt, and reduced interest charges they would have incurred if they handled the debt on their own. Following a debt management plan did take some discipline, but the reward was getting a handle on their credit.

Lesson #3: You don’t have to go it alone

For this couple, a financial counseling session, working one-on-one with a certified expert, was a good first step. A trusted source, along with advice and an action plan that provided tried and true strategies, propelled Matthew and Kendal toward financial health with confidence.

GreenPath is here for you

As Matthew and Kendall’s story illustrates, it is possible to get smart about credit and manage your debt. GreenPath offers free financial counseling and education to assist in assessing your financial situation and creating a personalized plan to achieve your goals. GreenPath works with thousands of people each month to pay off debt, improve credit and lead a financially healthy life. It all starts with a conversation for you to create an action plan to work toward your specific goals.