When you send money to people you do not know personally or give personal or financial information to unknown callers, you increase your chances of becoming a victim of fraud. Seems pretty straight forward, right? In fact, scammers are highly trained to find pressure points and throw their targets off of their logical thinking in order to obtain their money. Oftentimes a victim might not realize they have been scammed for weeks or even months. Here are a few tips to recognize scammer behavior before it’s too late.

Remember that scammers:

- Try to gain trust by claiming to be from a well-known business or impersonating a known contact

- Will suggest their own verification procedures, like going to websites they have created or calling numbers they provide to you

- Know how to appeal to your emotions and press your buttons to get what they want

- Create a sense of urgency to get you to make decisions without thinking.

Behavior that can make you a target for scammers:

- You respect authority. Many common scams are perpetrated by crooks impersonating a police officer, an IRS or Social Security agent, or a court representative. Always remember this: Government offices rarely call citizens to conduct business — and they never demand quick payment.

- You like to please people. No matter how trusting or kind you are, it is good practice to always be skeptical and aware that you may be a target of a scam.

- You are confident. If you’ve never been defrauded or believe you are immune to being cheated, think again. Scammers are professionals — and endlessly creative.

- You slipped up once. If you have already been a victim of fraud, chances are good the fraud calls and attempts will increase. Fraudsters put your information on a “victim list” that gets sold to other scammers or criminal rings.

- You’re friendly. Many people get scammed on social media via a friend request. Try to limit social media contact to real friends and family, and turn down requests from people you don’t know.

- You are under stress. People are often tricked into giving away personal info while dealing with an illness or another stressful event. People who have recently lost a loved one are also vulnerable, especially if the obituary reveals details that a crook can use as bait. Be especially vigilant during times of crisis.

- You’re lonely. Many scam victims report feeling lonely and isolated from family and friends. That makes them susceptible to the fake friendliness of professional thieves.

To protect yourself from the damage of identity theft and fraud, learn more about some common scams:

Government

- The IRS – Tax scams persist year-round, threatening people with jail time or prosecution if they don’t pay debts to the Internal Revenue Service. Given that fake IRS phone calls continue to plague consumers, the IRS itself has repeatedly published a list of things you will not experience with a legitimate IRS representative, including phone calls demanding payment, threatening arrest and asking for specific payment methods like a prepaid debit card. Learn more

Rewards & Prizes

- Lottery scan or advance fee fraud “419” frauds. Named after the relevant section of the Nigerian Criminal Code, this fraud is a popular crime with West African organized criminal networks. There are a myriad of schemes and scams – mail, email, fax and telephone promises are designed to entice victims to send money, ostensibly to bribe government officials involved in the illegal conveyance of millions outside the country. Victims are to receive a percentage for their assistance.There are many variations of phishing and 419 schemes, but they all have the same goal: to steal the victims’ money or personal and account information. Click here for a list of the most common variations of the 419 scam.

- Investment Scams – Salesperson convinces a senior that an unusual asset, like a horse farm, is worth significant investment. Learn more

- Charitable donations – Unscrupulous charities take advantage of generosity and memory loss to request donations repeatedly. Learn more

- Grant fraud scam – Perpetrator poses as a representative of a government agency or some other organization with an official sounding name. He or she contacts older adult notifying him or her that they’ve been selected to receive a grant and requests the older adult’s checking account number in order to deposit grant the funds into the account.

- Sweepstakes – ‘Contest’ claims a senior won a prize and needs to send in money to collect winnings.

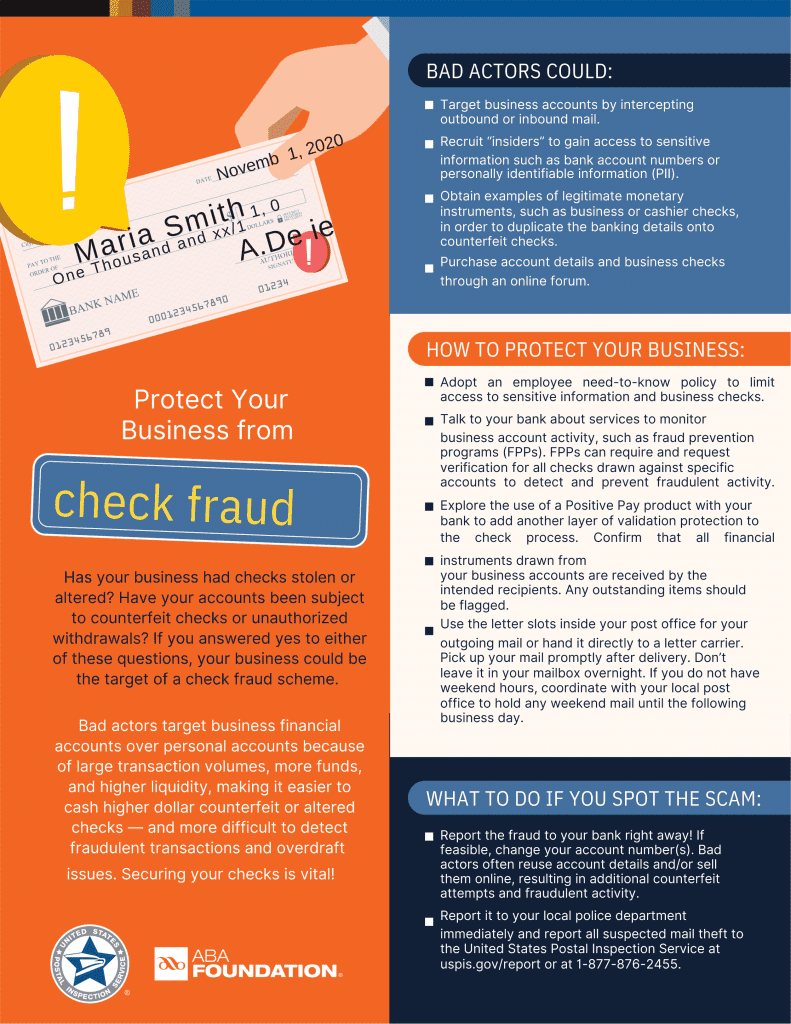

Money & Finance

- Money transfer scams – Often part of an Advance Fraud Scheme, a perpetrator convinces an older adult to send funds via Western Union or other money transfer services, using a number of elaborate schemes.

- Mystery shopper – Perpetrator enlists older adult to become a “mystery shopper” for them and sends older adult a counterfeit cashier’s check. They are instructed to cash the check, wire a portion back to the perpetrator and keep the remaining amount (appeals to those on a fixed or limited income).

- Misappropriation of income or assets – A perpetrator obtains access to a vulnerable adult’s Social Security checks, pension payments, checking or savings account, credit or ATM cards, and withholds portions of checks cashed for themselves.

- Charity scams – The victim is persuaded to buy a valueless or nonexistent product, donate to a bogus charity, or invest in a fictitious enterprise. Seniors are particularly vulnerable to this type of fraud because they are often at home during the work day to answer the phone. Social isolation is also a factor where fraudsters prey on lonely seniors anxious for someone to talk to. They devise schemes that require multiple phone calls and development of a trusting relationship.

- A payday lender – “Congratulations, you’ve been approved for a payday loan!” This is a variation on the sweepstakes scam and the call from “your credit card company” offering you lower interest rates. A good rule of thumb: If you didn’t apply for a loan, ask for a rate adjustment or enter a sweepstakes, it’s probably a scam.

- Reverse mortgage scams – Reverse mortgage scams are engineered by unscrupulous professionals in a multitude of real estate, financial services, and related companies to steal the equity from the property of unsuspecting senior citizens or to use these seniors to unwittingly aid the fraudsters in stealing equity from a flipped property.

- Obituary scam – Using obituaries to target recent widows, scammers attempt to collect false debts of the deceased.

- Magazine subscriptions – Company sends free magazines and convinces a senior he owes money for the subscription.

Family & Friends

- Yourself – If your own phone number ever pops up on your phone screen, don’t answer. It may seem harmless in the moment, but this scam reportedly collects and classifies numbers of people who answer the phone as good numbers to target with other scams. It may be tempting to see who’s on the other end of the line — since it clearly isn’t you — but you may be signing yourself up for many more unwanted phone calls.

- Identity theft – Using one or more pieces of the victim’s personal identifying information (including, but not limited to, name, address, driver’s license, date of birth, Social Security number, account information, account login credentials, or family identifiers), a perpetrator establishes or takes over a credit, deposit or other financial account in the victim’s name. Fraudsters gather victim’s information through various means; however, senior citizens are often susceptible to social engineering techniques that fraudsters use, such as “phishing” to entice victims to supply personal information such as account numbers, login IDs, passwords, and other verifiable information that can then be exploited for fraudulent purposes. Phishing is most often perpetrated through mass emails and spoofed websites, but it can also occur through old fashioned methods such as the phone, fax and mail. Learn more

- Fake accident ploy – Similar to the Grandparent scam, here a perpetrator convinces an older adult that the older adult’s child has been seriously injured or is in jail and needs money for medical treatment or bail.

- Fictitious relative – The perpetrator calls the victim pretending to be a relative in distress and in need of cash, and asks that money be wired or transferred either into a financial institution account.

- Online Dating and Romance / Sweetheart scams – The perpetrator enters the victim’s life as a romantic interest in order to gain influence and eventual financial control. This type of scam often goes unreported due to the embarrassment and emotional impact on the victim. At times the victim knows they are being duped but they simply don’t want to be alone. Click here for more about Romance / Sweetheart scams.

All of these tactics can put you at risk for identity theft, fraud or financial losses that could damage your credit or financial stability. If you receive a suspicious phone call, you can report it to the Federal Trade Commission, and as a fraud-monitoring precaution, it’s a good idea to regularly review your credit scores and reports for signs of abuse.