You have probably heard a lot about AI, or Artificial Intelligence – and not just in movies anymore! There are tools like ChatGPT that are becoming more widely used, and AI image generators like Microsoft’s Dall-E 3 have recently become much more easily publicly accessible. There are also websites like “Which Face is Real” which use both real and AI generated images to test users’ ability to distinguish the truth.

But AI is not all fun and games. Bad actors are making use of these tools to trick consumers and to undermine bank security measures.

It’s a numbers game

Tech-savvy perpetrators have always made use of new technology to take advantage of everyday people. For instance “spoofed” phone numbers, in which a call coming in appears to be from a loved one’s number, have been common practice among bad actors for some time.

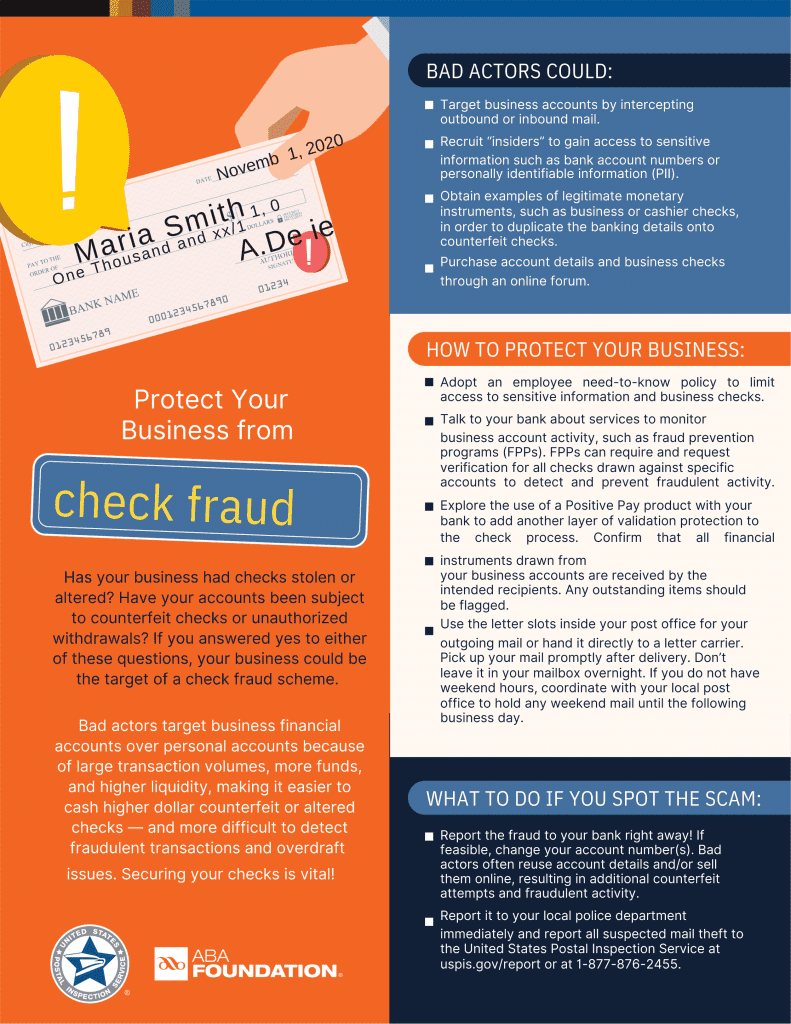

Another common tactic is known as a “BIN run” in which someone attempts to process thousands of unauthorized transactions on fake debit or credit card numbers, hoping to stumble upon a series of real debit or credit cards. “BIN runs” are identified as part of routine bank fraud prevention – learn more about them in this video.

Then, there is Synthetic Identity Theft Fraud – a data-driven scam in which, according to Equifax.com, “a real person’s Social Security number (SSN) is stolen and then a name, date of birth, mailing address, email account and phone number are made up and applied to that legitimate SSN to create a new identity.” Frequent victims of this type of identity theft fraud include young children with no credit history and older adults making infrequent financial transactions – without reviewing one’s consumer credit report, these scams can be difficult for victims and financial institutions to detect. Visit IdentityTheft.gov if you suspect you or a relative have been a victim of Synthetic Identity Theft Fraud.

Voice Theft (it’s not just in The Little Mermaid anymore)

Lately, there have been reports of scammers using AI tools to generate “spoofed” voices – their tools can “scrape” content from the internet like videos on social media to create a digital program that replicates a loved one’s voice. This effort is aimed at tricking unsuspecting consumers and also poses a threat to bank fraud prevention.

On social media, “deepfake” videos featuring celebrities are widespread. (It’s important to note that celebrities and public figures have hours and hours of recorded audio and behavior available upon which generative AI can operate.) At the same time, efforts to combat misinformation are ramping up just as quickly. Viral videos containing misinformation are being labeled as such by both human experts and AI tools trained to detect misused AI.

Similarly, bank fraud prevention software is more and more sophisticated. Voice ID software is trained to recognize digitally spoofed voices—the software we use at Kennebunk Savings is trained to recognize more than 100 separate attributes about individual manners of speech, adhering to your unique, biometrically matched “voiceprint.”

Manual fraud prevention measures such as a “code word” between you and your loved ones and your trusted financial institutions can also combat these attempts at voice theft. At Kennebunk Savings, our first and best bulwark against identity theft fraud is, as always, the real people staffing our phones.

As with all Identity Theft fraud cases, the technology alone is not enough for scammers to steal your identity, so be mindful of where and to whom you are providing sensitive personal information. “Social engineering” is the process by which scammers can glean personal details, perhaps through your social media or through what appears to be an entirely different scam, in order to finalize identity theft fraud.

Keep your SSN and other crucial identification documents and information secure. Know the warning signs of phishing scams and follow basic rules like never call the phone number provided in a suspicious email. Keep an eye on the URL of websites you believe to be visiting to ensure they are the real deal (watch our video to learn how). Be suspicious of unexpected communications from people claiming to be from the government, antivirus companies, and financial institutions. If you believe you are being scammed, give us a call at 1-800-339-6573

We’re paying close attention to these evolving trends and working to prevent identity theft fraud.

Learn more about Kennebunk Savings’ secure banking services.