Your Information is Out There

If we really want to keep ourselves – and our money – safe from fraud, we must all come to terms with one thing: our personal information is likely already out there. Many entities have our personal information – credit card and bank account numbers, Social Security numbers, and health-related information – and data breaches have most likely exposed it. So, what can we do to protect ourselves after the fact?

Here are three steps towards protecting yourself against identity fraud. 1) Place a security freeze on your credit accounts with the three big agencies so no one can open a new credit line in your name; 2) Establish online access to your financial accounts and monitor regularly (you can set up text alerts for activity on these accounts); 3) Use strong and unique passwords for every online account; consider using a password manager that creates complex passwords and stores them securely.

Three Words to Remember

Remember these three words: stop, think and verify.

Criminal scammers need one thing to be successful. They need to get their victims into a heightened emotional where they don’t take the steps they normally do before making a decision – many call this being in “the ether.” Once someone is either so scared or excited and motivated to take action quickly they can miss some of the typical warning signs of a scam.

This is where the three words can help. Before making any sudden decision involving money try and stop by disengaging from the call, text or email. Once you have pressed pause think about how this situation or opportunity got put in front of you. Is it logical, does it make sense. And if you think it might be legitimate then verify it on your own by contacting the source through other means, not the phone number or link that was sent to you.

Know Your Seller When Shopping Online

One key to shopping online is reading the fine print, including who you’re actually buying from. While we often think of giant online retailers like Amazon, Walmart and Target as a store they can be more like a mall or flea market where you are buying products from a variety of sellers. However, some of those sellers are more reputable than others.

Criminals use these websites to resell stolen products or items that either don’t work or contain dangerous chemicals. One easy way to protect yourself is to make sure you are buying directly from the retailer that runs the website. You can usually find the seller’s name on the product page near the button for buying the item. Shipping times and return policies are another sign of who you are buying from as products from the branded retailer will often ship faster and have a clear return policy.

As of the third quarter of 2023, online shopping scams were the second highest category of fraud reported to the Federal Trade Commission, and 51% of those reporting lost a combined $308 million. The actual losses are likely far higher since fraud is significantly under-reported.

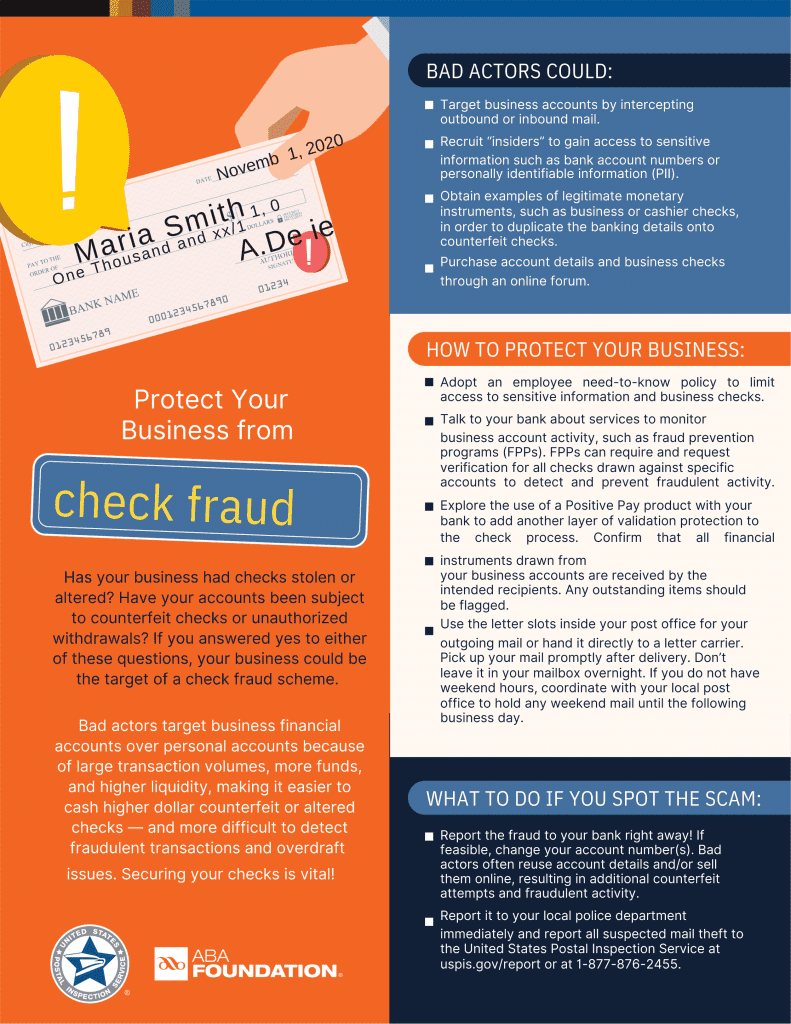

A New Take on an Old Scam

One of the oldest scams around involves a criminal getting hold of one of your checks and forging the payee and the amount. Usually this is done by “washing” the check with chemicals to remove the real information you have written on it. Today, with access to new technologies, criminals are “cooking” checks by creating fake versions of real checks using computer programs. These “cooked” checks can be manipulated digitally and either printed or deposited electronically, saving the crook a lot of mess and hassle.

The best way to protect against these scams is to be careful how you send checks. If you use your checkbook to pay bills via mail, how you send those bills is the key to staying safe. Rather than dropping the bills in your mailbox and flipping up the flag, take them to the post office and drop them off inside. A criminal can’t wash or cook a check they don’t physically have, so taking this extra step to safeguard your mail can protect your bank account in the long run.

Getting Help After the Scam

If there is one thing everyone should understand, it is that “scammers” are career criminals skilled at the art of manipulation, and no one is immune. These crooks target people of any age; in fact, 41% of those who reported a fraud loss to the Federal Trade Commission in 2023 were under the age of 30. So, what can a person do if they experience fraud?

One resource is the AARP Fraud Watch Network Helpline. Every weekday, trained AARP volunteer fraud fighters are helping victims and their families understand what happened, report the crime, and start to put their lives back together. That number is 1-877-908-3360. We also offer an online small group victim support program to help address the emotional harm fraud victimization causes. Learn more at aarp.org/fraudsupport.

If you or someone you know has been the victim of fraud, make sure to file a report with local police; among other things, you will have this as evidence in the event restitution becomes possible down the line.