‘Tis the season for online shopping and donating to your favorite charities! While you’re fulfilling wish lists and spreading goodwill, here are a handful of tips to help protect your personal and financial information through the holidays.

1. Keep Personal Information Confidential

Unless you are talking to a verifiable customer service representative from a company you’ve called yourself via a trusted number, you should never give out your account number or any personal information. Even if you feel you need to hang up the phone to validate the call, trust your gut—the person on the other end of the line will understand if they’re legitimate.

2. Use a Credit Card

Many people understandably make online purchases with their debit cards, but given the fact that these link directly to bank accounts, industry experts recommend designating one credit card (as opposed to debit) for handling all of your online transactions. This way, it’s easier to track and validate online charges and in the event your information is compromised, recovery will be far less stressful.

3. Review Statements Regularly

It’s easy to be lax about keeping up on how you’ve been spending your money, but you owe it to yourself to review statements on a regular basis. This way, you can monitor for any unusual charges and call your financial institution as soon as possible to address the issue.

4. Set Up Text Alerts

Setting up alerts that are sent via text message to your phone each time a purchase or withdrawal is made is a surefire way to spot an unusual charge as soon as it occurs and one of the first steps toward properly monitoring your accounts for identity theft.

5. Avoid Public WiFi

If you’ve ever been in a coffee shop and connected to a public-access WiFi network, you’ve likely put your data in jeopardy while doing so. You never know who else may be on the network looking to capture your information, so avoid using public WiFi unless it’s a dire emergency.

6. Verify URLs

Whenever you find yourself shopping online, the URL of the website you’re on should begin with “https://” (note the presence of an “s”). If not, there’s no way to verify that it’s actually safe to shop on that particular site.

7. Change Passwords Regularly

When was the last time you updated your passwords? Most people don’t want to put in the effort or are afraid they won’t remember new passwords, but using the same PIN or password over and over is a direct route toward setting yourself up for fraud. Why? If someone is trolling for your information and you happen to log into Netflix with the same password as you use to access your online banking, all of a sudden, they’ve got the keys to your entire kingdom.

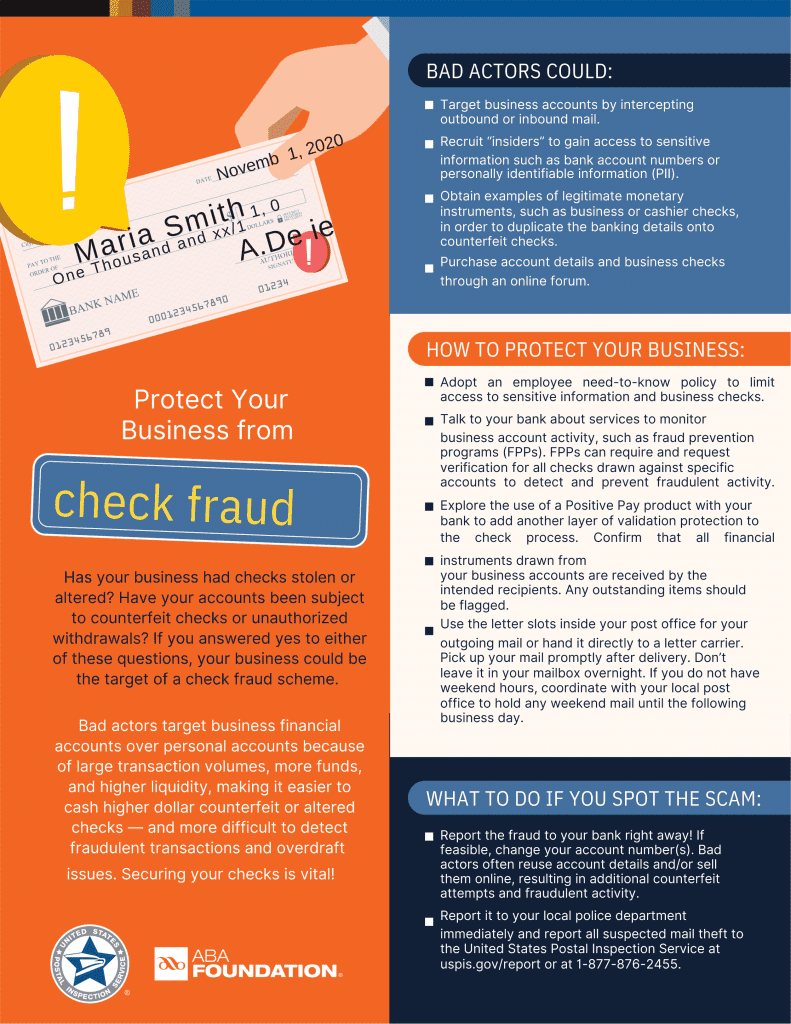

8. Brush Up on Today’s Scams

New scams (phishing scams, for example) pop up with such frequency that people find themselves dealing with them on a regular basis. Brushing up on these “repeat scams” can give you a clear picture of what to watch out for. Visit these trusted resources to familiarize yourself with common scams: Fraud.Org and the FBI’s website.

9. Install Protective Software

Antivirus and anti-malware software are not relics from the past—they’re actually more pertinent and necessary today than ever before. Be sure to add and regularly update these types of software on all of your devices and keep them up to date with the latest software security patches. Additionally, ensure that all of your software (Office, Mail etc.) is set up to receive automatic updates, which often contain time-sensitive security patches.

10. Shred Documents

Those old financial statements that are laying around your home? They can mean real trouble if they fall into the wrong hands. Shred old documents as soon as you’re done with them to be sure they never come back to haunt you. For documents you need to keep around, be sure they’re locked away in a private area, as you never know what may happen if this information ends up in the wrong hands.

11. Pull Your Credit Report

Every American is entitled to one free credit report per year from each of the three major credit bureaus—Experian, Equifax and Transunion. By pulling a report every three to four months from each bureau instead of all at once, you’ll be able to keep close tabs on any suspected errors and dispute them immediately. To pull a report for free now, visit www.annualcreditreport.com.

Take these steps and feel more confident shopping and managing your finances online.