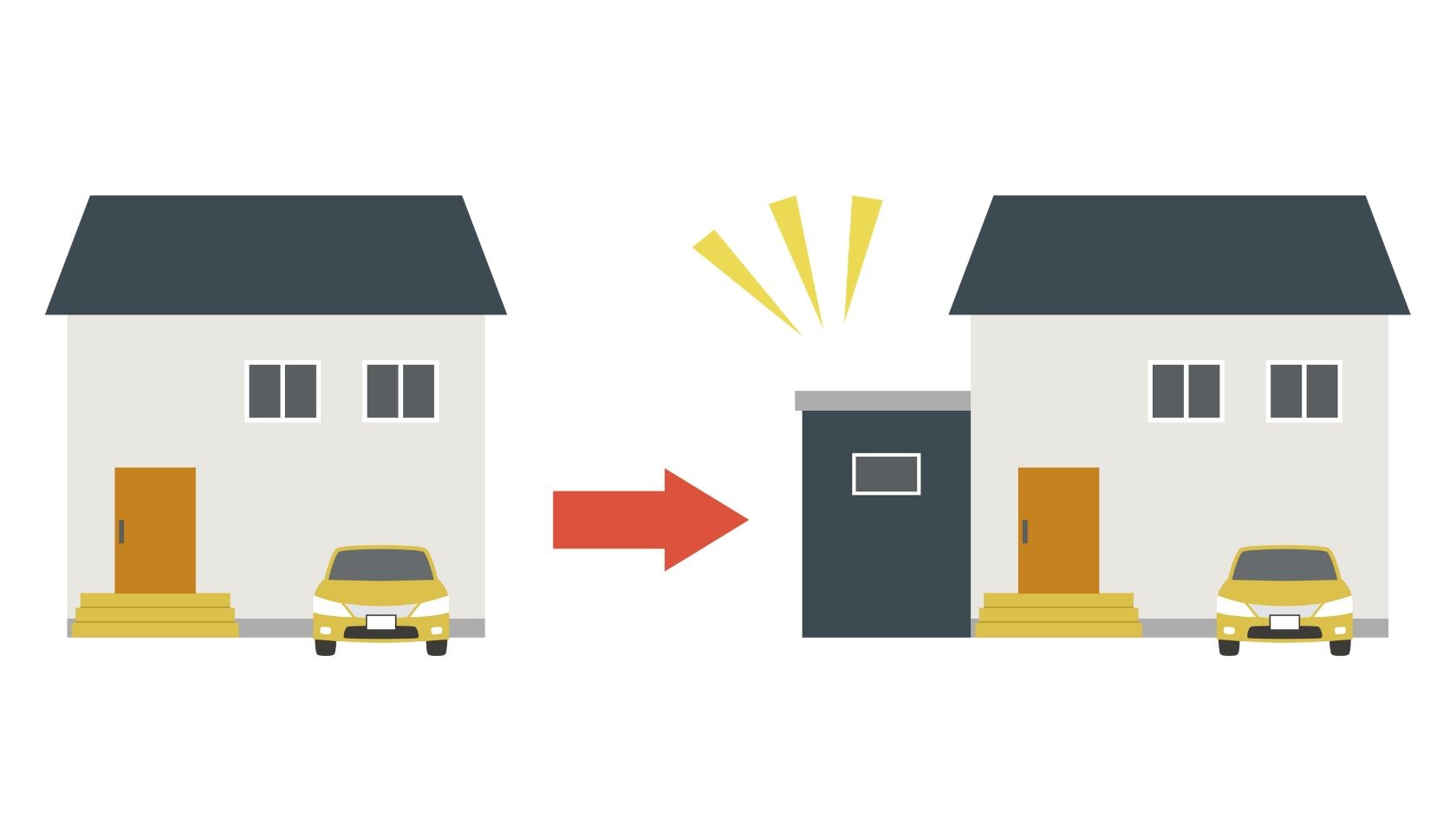

Add living space that fits the needs of your family.

Whether you are looking to provide options for aging parents or earn rental income — an ADU loan might be a good fit.

An ADU loan is a new product developed to provide financing options to fit the needs of our community. These loans can help achieve adding livable space to your existing home, or even building another structure on your current property. If you have a growing family and need more room or would like to add an income generating apartment in your home or build an addition for aging family – this type of a loan can fit those needs.

What to know before you consider an ADU loan

We’re excited you are thinking about an ADU loan*. Here are some quick facts you should know!

- You can finance up to 89.9% of the as complete appraised value

- Eligible properties can consist of primary residences, 2nd homes, or 2-to-3 family primary residences, if city/town permits

- If your city/town allows it, you can add on to your existing home/property or build a new structure on your existing land

Accessory dwelling unit loan FAQs

What is an accessory dwelling unit (ADU)?

What can I use an accessory dwelling unit for?

How do I get information about a building permit?

How big can an ADU be?

How far can an ADU be from the main house?

Why would I get an ADU loan rather than a HELOC or refinance?

Do I need special insurance for an ADU loan?

Contact a lender today!

Let’s see if an ADU loan is the right choice for you. Our residential loan officers are here to help you understand all the details. Call us to talk or schedule an appointment or send an email.