Manage your banking accounts with confidence

Get banking advice, watch video tutorials and use our calculators to learn how you can make smarter decisions for your future.

- Article

- Calculator

- Video

- Podcast

- Credit Cards

- Online & Mobile Banking

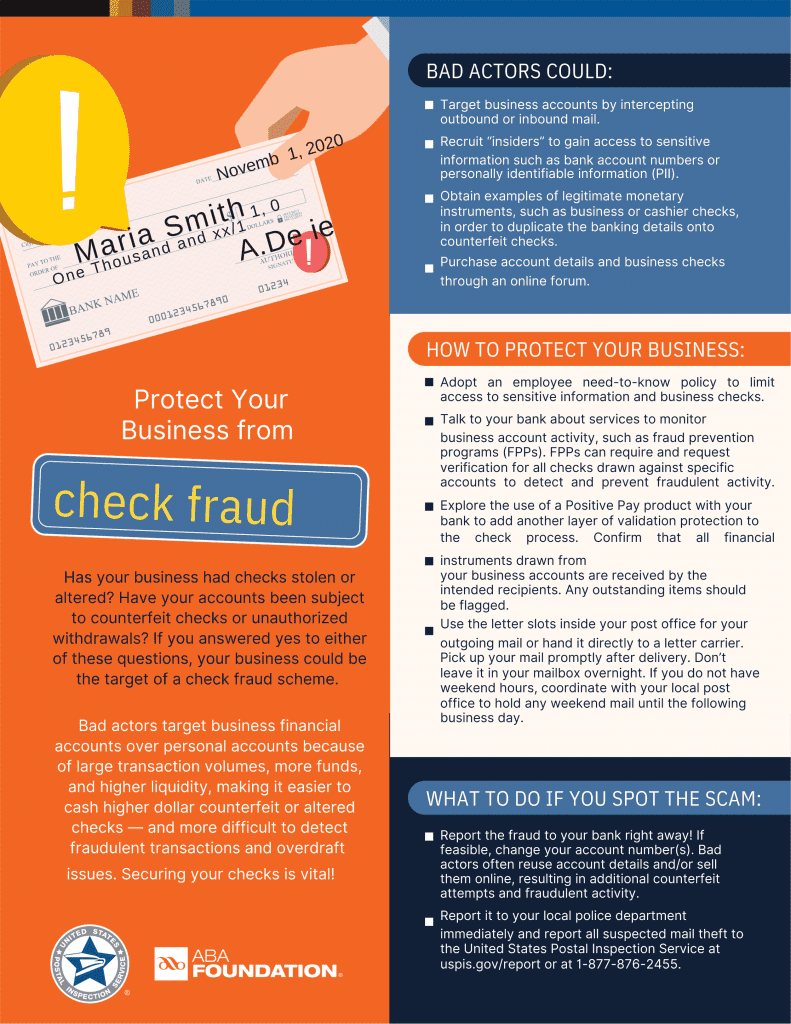

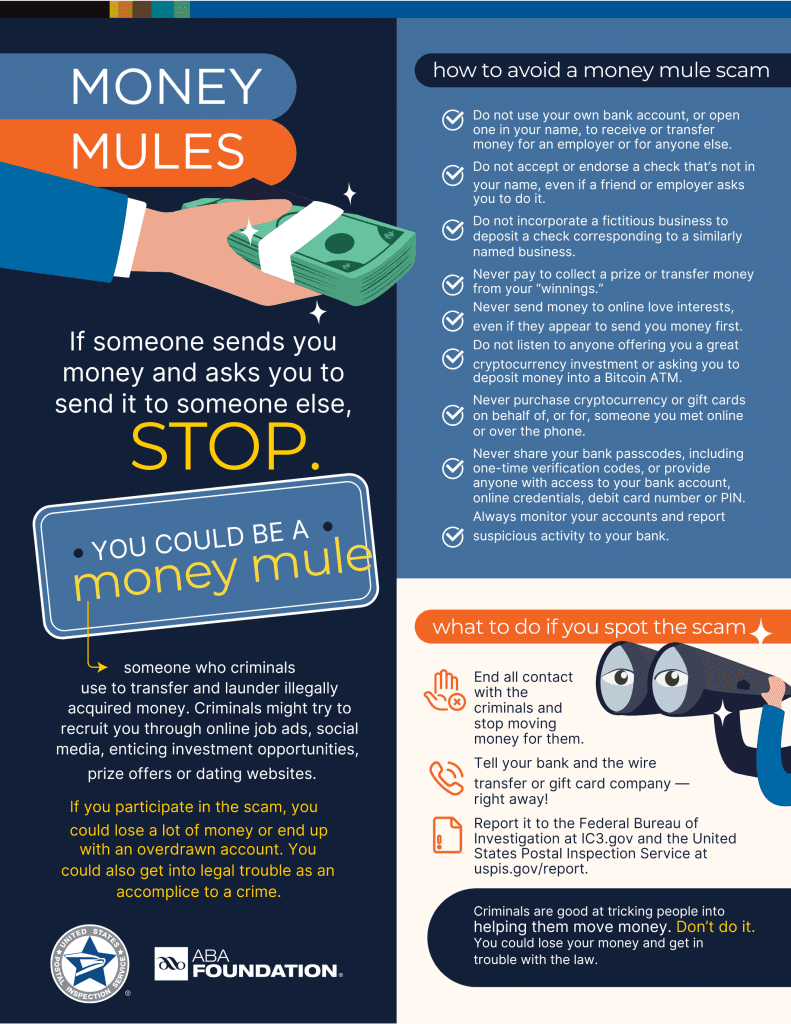

- Security & Fraud

- Financial Wellness

- Checking

- On-Demand Webinars

- Personal Banking

- Business Banking

- Mortgage & Home Equity

- Savings & Retirement

- Loans

- Insurance

Sorry, there are no resources that match your filter selection.

To get more results, try changing or removing your filters.