Our strong sense of purpose helped us grow, improve, and innovate over the last year. Check out our year in review video below and relive it with us!

Relationship focused

You know when you wake up feeling lucky to love what you do? That’s us. Our passion shines through as we strive to be role models in the community. In our online and mobile world and we spend a lot of time trying to find better ways to give customers the kind of assistance they need in those spaces, but our favorite moments are still the ones when customers walk through the door to visit us in person. We hope we’ll see you, too.

Innovating for the community, not for ourselves

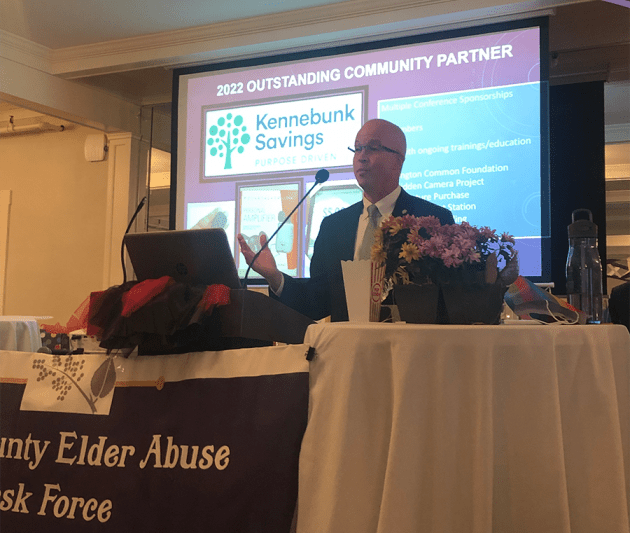

We live here too. Getting to know our customers and our community means we understand there are things we can’t control. In our work, we’re empowered to act based on the character of the businesses that hold our communities up and connections we make by being part of the neighborhood. It’s not just about the bottom line. We want to give back and make a positive impact. Because helping one another is the right thing to do.

When I think about Kennebunk Savings, I think about Community, Hope, and Empathy. The passion my coworkers share for our communities empowers me – it drives me to be a better employee, volunteer, and person. Morgan-Lee Brooks Vice President, Relationship Development Team Lead

We’re here to be more than a bank for you, and we hope to establish a personal connection so you can see our expertise and our commitment to the community.

We’ll always be honest with you and guide you toward the best financial decisions for you.

We’re always thinking ahead and refining our products and services to ensure they’ll be ready for all of life’s moments.

As your neighbor and your banker, we want to see you thrive in our shared community.

Quick facts about Kennebunk Savings

- Headquartered in Kennebunk, Maine

- Assets of $1.82 billion

- Mutually owned, Maine-chartered community banking institution

- 2024 Annual Report

- Branch and office locations in York County Maine and seacoast New Hampshire.

- Contributes 10% of its after-tax earnings back to the nonprofit community each year through its Community Promise program.

- The total commitment of that program has meant nearly $14 million for nonprofits in the community since 1994.