Kennebunk Savings recently launched a new product: an ADU loan designed to help homeowners in the current climate add housing to their property in a financially viable way. We sat down with Matt Le, First Vice President, Retail Lending Director, to ask him some questions about it.

Note: All loans are subject to credit and property approval

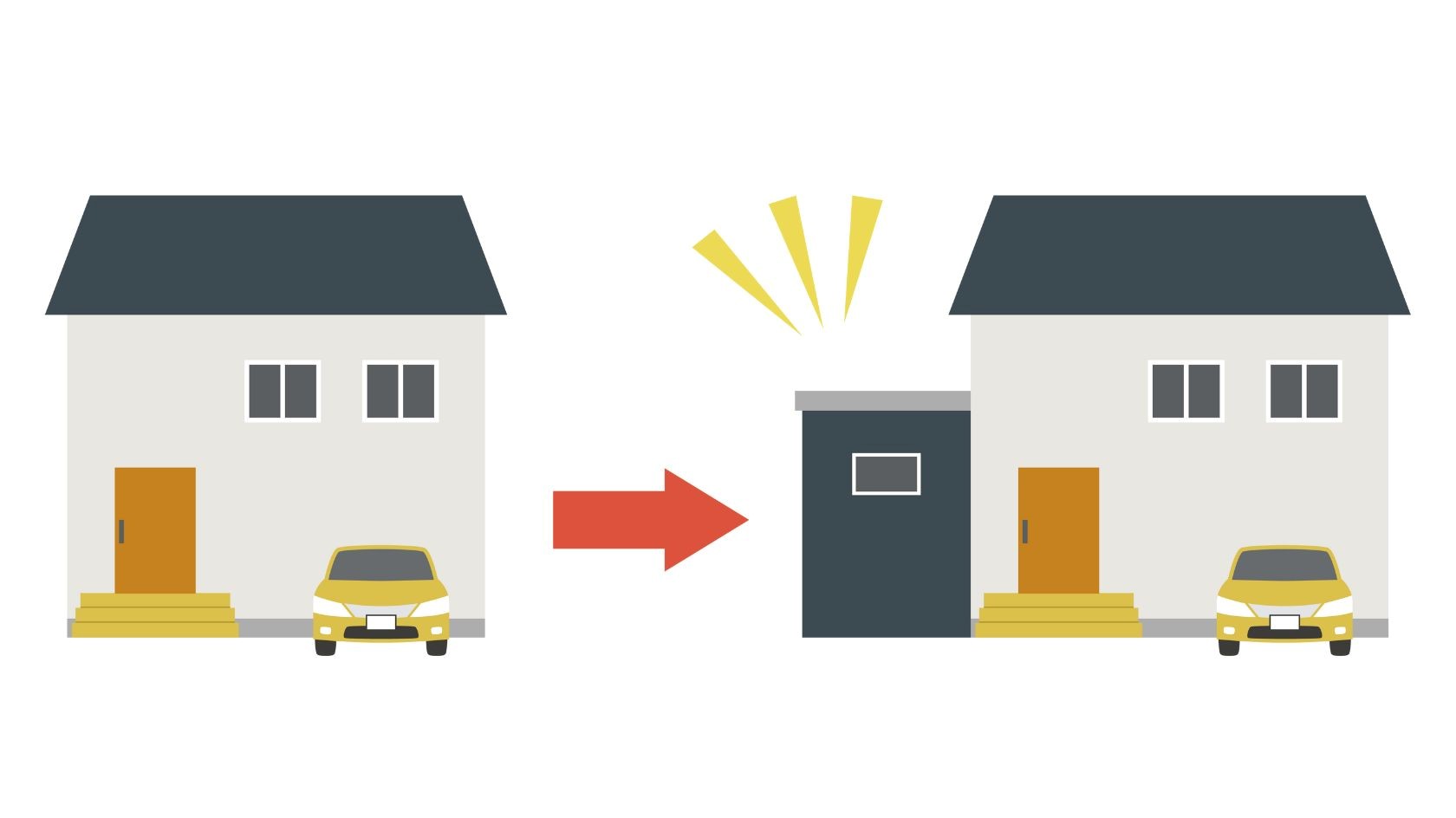

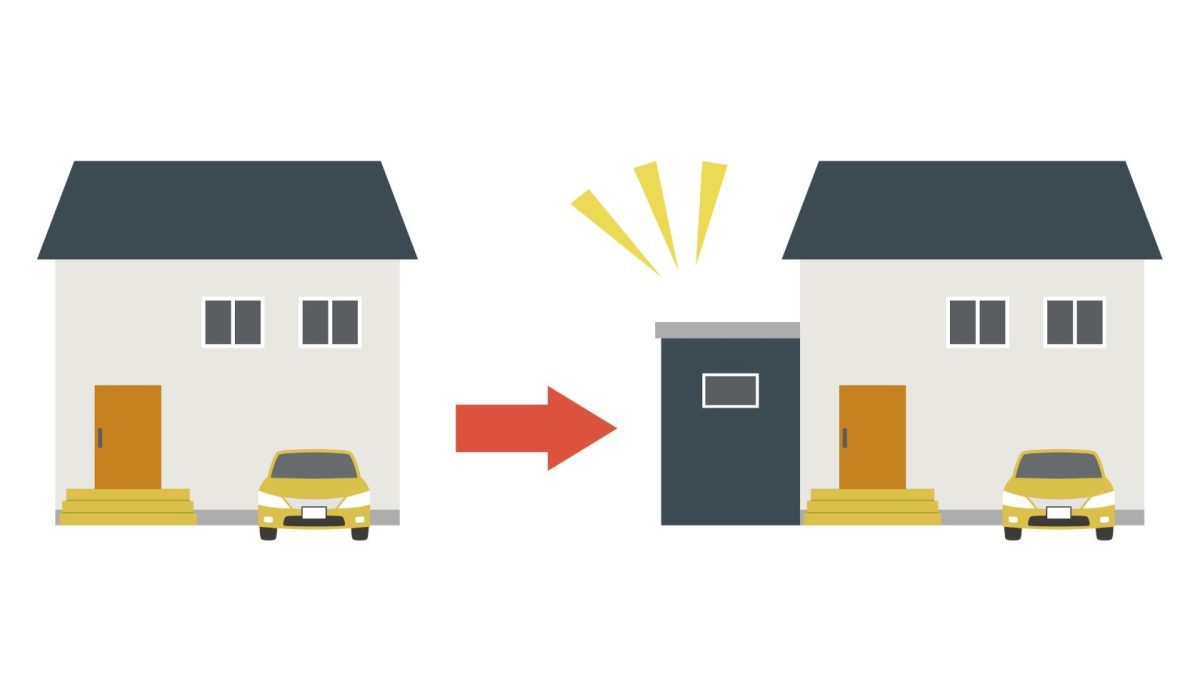

Q: What are ADUs?

Matt: ADU stands for “Accessory Dwelling Unit.” They are structures built on your existing property. This could be something as simple as a converted garage or a newly-constructed cottage in your yard. An ADU includes its own facilities—kitchen, bathroom, separate entrance—a place where a person or persons could live independently. They can be either attached or detached from your existing structures.

Q: What sort of person would want to build an ADU?

Matt: An ADU could be used to provide rental income, extend your existing living space, house extended family members, or to provide shelter for your family when renovating your home. If you are a homeowner considering any of these arrangements, you might want to look into what an ADU on your property would look like.

Additionally, rental ADUs can help alleviate housing needs in our communities. We all know how hard it is find comfortable and affordable housing. Homeowners can be a part of the solution by increasing the supply of quality housing, right on your own property.

Q: What are some things to keep in mind before getting started building an ADU?

Matt: First – the rules, ordinances, regulations, and zoning in your state, city/town, and possibly home owner’s association. Please be aware that many of these rules and ordinances are changing – it’s recommended that you go to your local city/town office to review those rules and ordinances with your code enforcement office.

Second—a general sense of your budget and plan. At Kennebunk Savings, you can finance up to 89.9% of the as-complete appraised value. Eligible properties can consist of single family primary residences, single family 2nd homes, or 2-to-3 family primary residences, if city/town permits.

Third – it helps to get a sense of who is building ADUs near you. Researching the local builders in the area is a great way to get a sense of how much you might need to spend.

Q:Why would I get an ADU loan rather than a Home Equity loan?

Matt: Completing an ADU loan will allow you to forego a refinance on your 1st mortgage that may be fixed at a lower rate. Therefore, the ADU loan may provide more flexibility as far as payment, term and leveraging equity in your home compared to a Home Equity loan. Please note again that all loans are subject to credit and property approval.

Q: Why did Kennebunk Savings design an ADU product? What sparked the idea?

Matt: Kennebunk Savings is very fortunate to have community partners that keep us in tuned and informed about what is going on in the communities that we serve. We already had a good understanding about the current housing crisis and its negative impact on people looking to either purchase or rent affordable housing. Based on that, our community partners made us aware of a potential solution that could help with the housing crisis–homeowners building ADUs. We invited many local advocates to our offices to discuss the challenges they were seeing in their communities, and we used their comments to develop a product that would better support our communities need for housing. We didn’t want to “over engineer” this product and make it feel too complicated or out of reach for the homeowner. We hope it will prove to be a small solution toward the bigger issue of the housing crisis in our communities.

Learn more about our ADU Loan!